Product and pricing, revolutionized.

It's time to get more from your PPE.

Built with patent‑pending technology to solve the core limitations of legacy solutions, Polly's revolutionary PPE is designed to maximize margins and facilitate speed, accuracy, and confidence across all loan pricing and lock processes.

We understand that banks, credit unions, and lenders nationwide need to remain agile in today's competitive market. When they have access to the most technically advanced and state‑of‑the‑art solutions, configuring new products and channels is significantly easier. Workflows become automated, speed to market is increased, and they can truly optimize the margins and revenue on every loan.

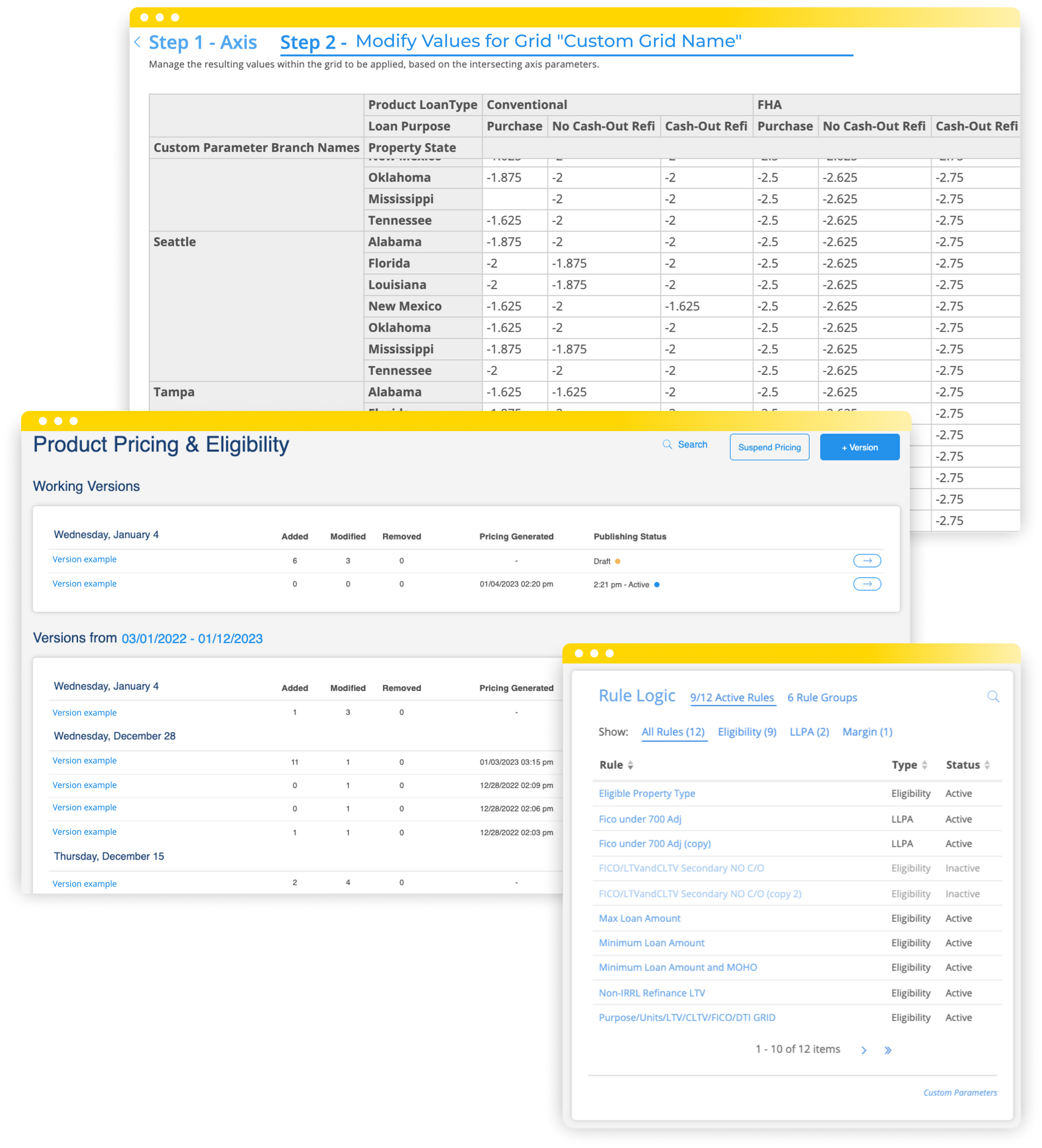

RULE CONFIGURATION

Native and sophisticated logic management tools eliminate the dependency on cumbersome and clunky tree‑ or folder‑type hierarchies.

VERSION CONTROL

Hold onto all historical versions, making it easy to go back and price on any old version, review a version, or bring a version back to life.

HISTORICAL DATA

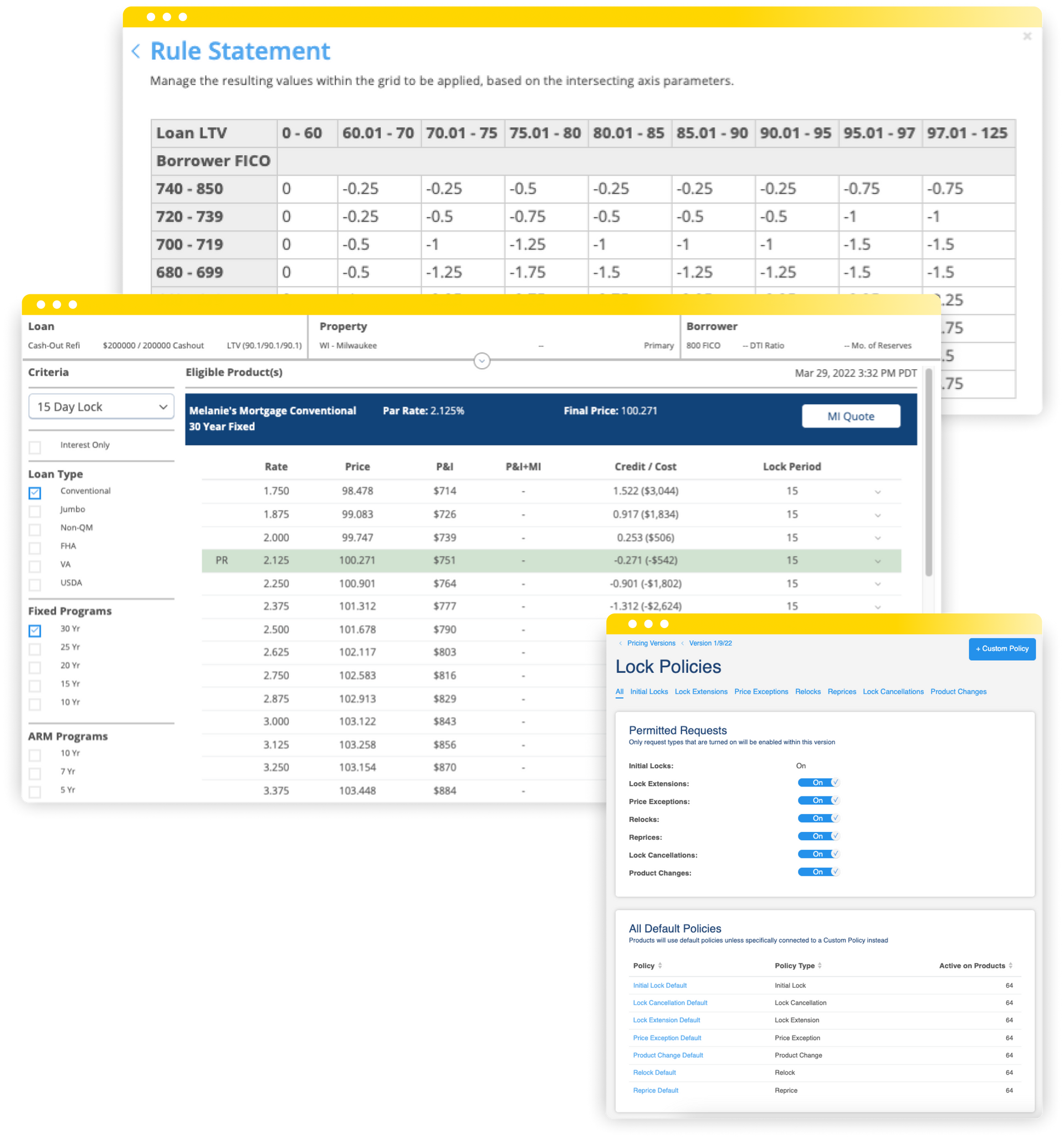

Re‑price automation and worse‑case pricing analysis enables users to run scenarios against prior days' pricing and configuration.

BEST EXECUTION

Run multiple loan types at a time to experience completely customizable, blended best execution.

MOBILE UI

Access accurate pricing and robust PPE functionality to run scenarios on the go, from anywhere and on any device.

NO-CODE DEPLOY

Set and test new products, pricing, and rules as they are configured in app, with zero vendor development required.

Price accurately with confidence

Tools, testing, and controls

Intuitive logic management tools create operational transparency and streamline workflows. Native test and audit capabilities enable users to test and interact with PPE updates in advance of release into your live production environment.

Dynamic, highly configurable margin management

Create custom margin management rules with infinite dimensions. Rules can be built and customized with unmatched granularity by investor, channel, branch, broker, product, loan type, loan term, and loan‑level parameters such as lock period, note rate, or any other tailored filter to support your specific need. Users also save valuable time with a copy/paste function.

Investor and HFA support

Polly's PPE is embedded with a variety of mortgage loan product types from hundreds of leading industry investors, including Conforming, Construction, Government, Housing Finance Authority (HFA), Non‑conforming, Non‑QM, Portfolio products, and more.

Custom parameters

Streamlined configuration of any custom parameter allows for unlimited flexibility, configurability, and scalability to support your unique business strategies. Via flexible APIs and the most modern integrations, users can easily map both standard and custom fields directly into any LOS to significantly reduce manual workload.

Lock desk automation

Flexible, automation‑enabled workflows

Polly's PPE is embedded with automated lock desk workflows including locks, extensions, re‑locks, re‑prices, price exceptions, float downs, and more to streamline processes for secondary marketing and capital market teams, and loan officers alike.

Only‑of‑its‑kind product change function

Need to change a product due to borrower or property eligibility post lock? Easily modify product type and term combination(s) to another as needed, be it historical pricing, worse case, or current market. Apply auto‑accept rules for any of these granular scenarios to experience even more time savings and workflow efficiencies across your mortgage operation.

User experience

Fully customizable workflows and native automation facilitate a better lock desk experience, as they are designed to eliminate errors and promote precision and accuracy in any market environment.

Hear from a lender just like you.

In a recent study, an award‑winning lender client illustrates how they used Polly's PPE and Loan Trading Exchange to save hours of configuration time each week, optimize the loan sale and settlement cycle, and increase their overall profitability by 12%.

Let's talk!

Corporate HQ:

548 Market Street, Ste. 25656

San Francisco, CA 94104

Customer Success:

Jackie Studdert

Sales:

Kevin Fleishman

Media and Corporate Inquiries:

Samantha MacKendrick