Meet Polly/ AI: The future of mortgage AI.

Harness the power of AI in a way that is actually applicable to today's modern lender.

Bolstered by Polly's proprietary technology and data, Polly/™ AI leverages powerful artificial intelligence, machine learning, and natural language processing (NLP) to transform the way mortgage industry participants are able to engage with AI.

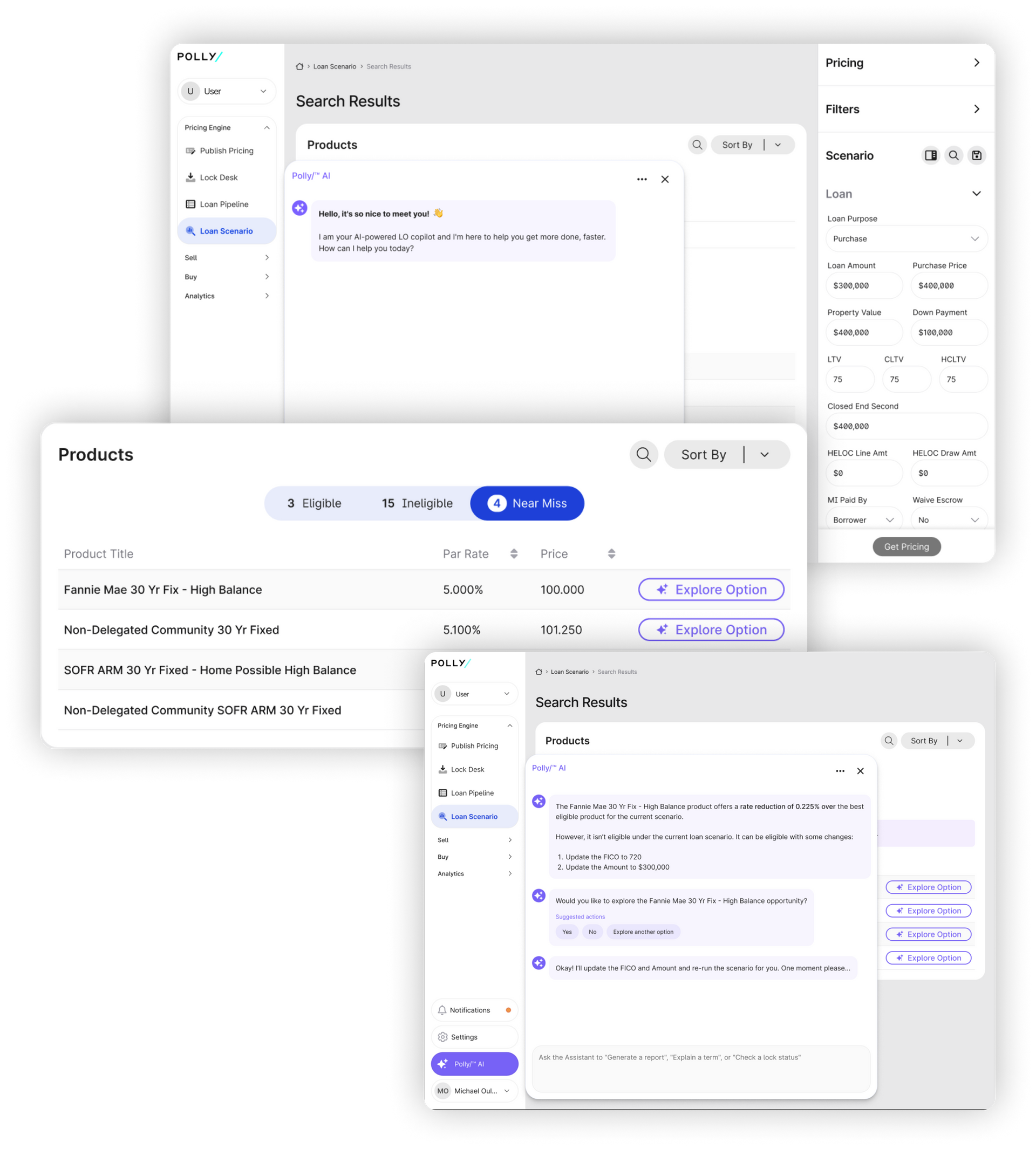

Polly/™ AI's first application, an intelligent Loan Officer (LO) Agent, taps into the robust architecture and flexible back��‑end configuration of Polly's revolutionary PPE. The agent can examine near‑miss eligibility, process and interpret complex mathematical and logic‑based ineligibility statements, and proactively articulate specific, actionable recommendations that empower users, boost workflow and operational efficiencies, and ultimately increase loan conversion.

Polly's dedicated team of AI Engineers will continue to roll out new AI/ML features and functionality in real time! Request early access below to stay informed of what's coming next.

AI-powered agent for loan officers

Understand and convert ineligibility

Understanding a borrower's ineligibility and what can be done to make that loan eligible can be a time‑consuming and sometimes unattainable task. Polly/™ AI will comprehend and articulate ineligibility data points, transforming complex statements into actionable advice. With Polly's LO Agent, you can make ineligible loans eligible!

Proactively examine near‑miss eligibility and LLPAs

Polly/™ AI uses sophisticated data analysis to determine and communicate what an LO can do to create a more favorable borrower outcome based on scenarios that may otherwise be overlooked. The LO Agent will proactively identify the best price for the consumer across all scenarios. LOs can use this intel to optimize rates and pricing strategies, facilitating a better borrower experience and laying the foundation for a long‑lasting relationship of trust.

Identify product and pricing best fit

Say goodbye to lengthy and tedious form fill. With Polly/™ AI, LOs can use instant messaging or voice interaction to request best‑fit product and pricing information to share with their borrowers, all drawn directly from Polly's powerful pricing engine.

24/7/365 accessibility

Conveniently available via web or mobile device, LOs can converse and collaborate with Polly/™ AI to complete any workflow in a matter of seconds ‑ any time, and from anywhere. This enables them to focus on what matters most: forging deeper connections and better serving their borrowers.

Hear from early adopters of Polly/™ AI.

Polly/™ AI is currently in closed beta with several of the nation's largest mortgage lenders. The feedback has been overwhelmingly positive, with early adopters citing a substantial boost in productivity and strong efficiency gains by combining the powers of AI and Polly.

Let's talk!

Corporate HQ:

548 Market Street, Ste. 25656

San Francisco, CA 94104

Customer Success:

Jesse Decker

Sales:

Media and Corporate Inquiries:

Samantha MacKendrick